The above is his reply to what he thinks will happen with these companies that were trying to bankrupt GameStop and placed “all in” type bets that GameStop would fail (go bankrupt).

The firm lost billions of dollars and eventually collapses as it scrambled to cover its bets against the video game retailer GameStop.

Computer chair sounds awfully similar to Computershare. Some individuals post links to sources which seem to indicate there is litigation risk or lawsuits at stake if a company encourages their shareholders to Directly Register their shares. Aside from the fact the financial groups trying to originally bankrupt Gamestop have lost hundreds of MILLIONS by now, […]

This was speculated to happen for a few months prior to it being officially announced.

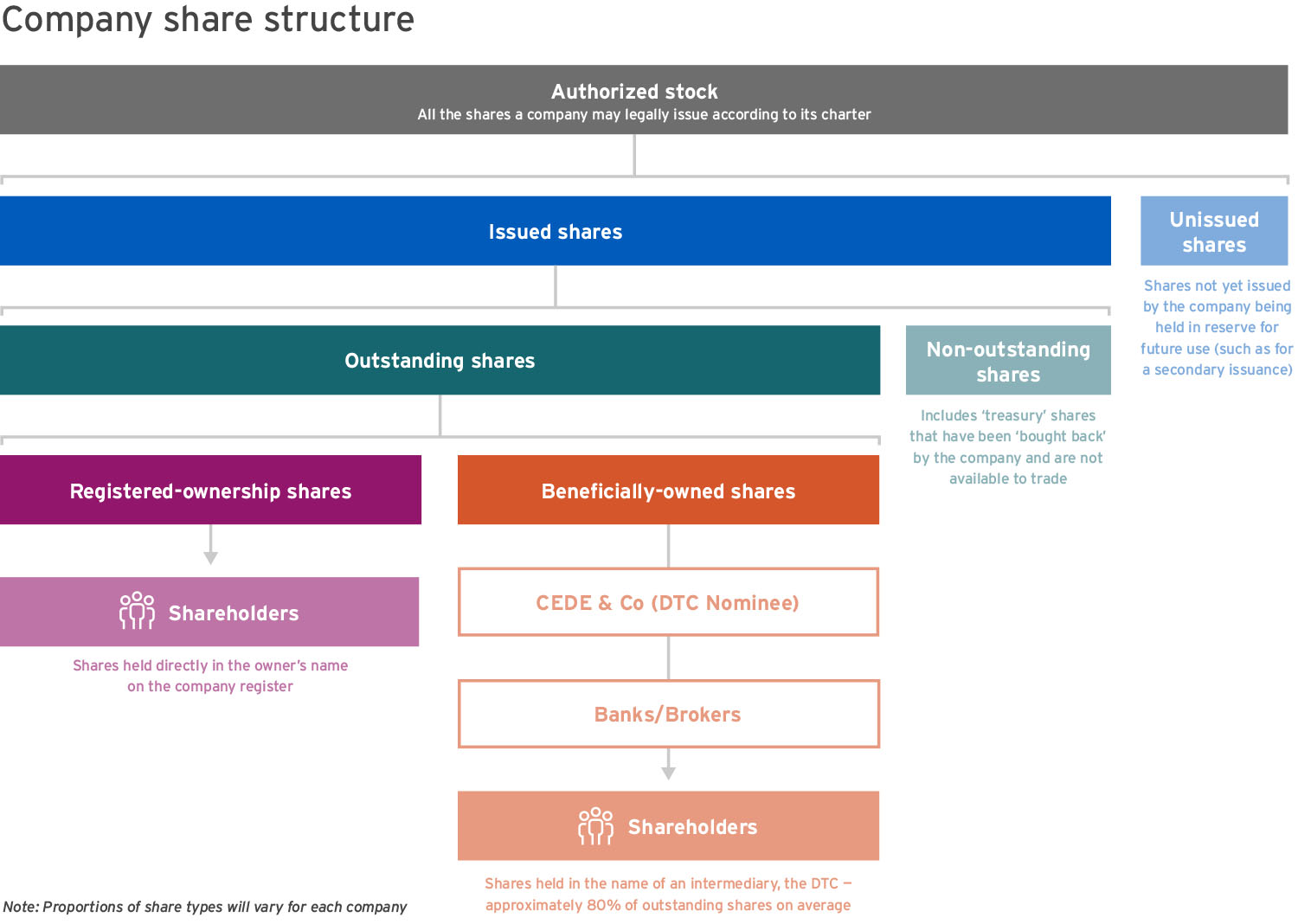

The consensus seems to be that no shares are safe with any broker, including popular brokers such as Fidelity. All brokers, thru their partnerships and agreements, use investor’s shares to loan or create phantom (rehypothecated) shares. By this time, Gamestop has been one the most bought stocks in certain brokers that share this data including […]

Some brokers immediately suspend and prevent Gamestop stock from further being purchased/bought. Considering that this is supposed to be a “free” stock market based on supply and demand, this should not happen. This creates more questions, concerns, and interest from investors around the world.