Links to video interview can be found in the source linked to this specific timeline event.

The BEST GameStop Timeline

The best time to be alive is now

As all eyes around the world are on this one single stock, I would like to invite you to read the admin notice.

Read Admin NoticeGameStop Timeline

Welcome to the best GameStop timeline ever created. The following events have since taken place shortly after GameStop was identified as the next target company to be purposely bankrupted by financial entities.

Massive bets were placed, potentially worth billions and billions and even trillions of dollars, that GameStop would go bankrupt. (Read a better explanation)

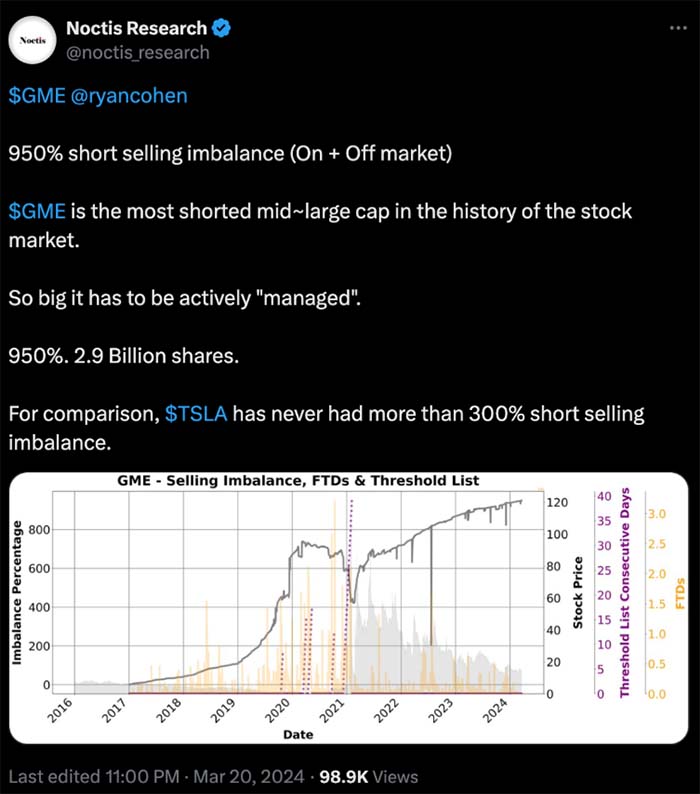

At the start of the GameStop timeline, there should only exist around 77 million shares of Gamestop. It is widely speculated financial groups may have created and sold several billion phantom shares via naked shorting which will need to be bought back at whatever price investors are willing to sell.

Hedge funds and financial investment groups at this point are starting to bleed millions and millions daily as they realize their plan to bankrupt GameStop is no longer a reality.

This timeline details the greatest story every told and will go down in history. Also, this type of event will never happen again!.

(Original link to X Post) reddit user RingingBells comment: Avi Perry is the DOJ official that now works as lawyer representing Citadel. Credit to user ‘Merica who did an excellent job sourcing user annie post’s post “Avi Perry, who has led the Fraud Section’s market integrity and major frauds team…

Read More

FTDs are stocks that need to be purchased or returned if they were borrowed.

Back in August 6, 2021 Mr Chanos called GameStop investors “Greedy and entitled”.

Some user reports indicate they also hear radio segments trash talking GameStop’s strategy as nobody knows at this time what Ryan Cohen will do next.

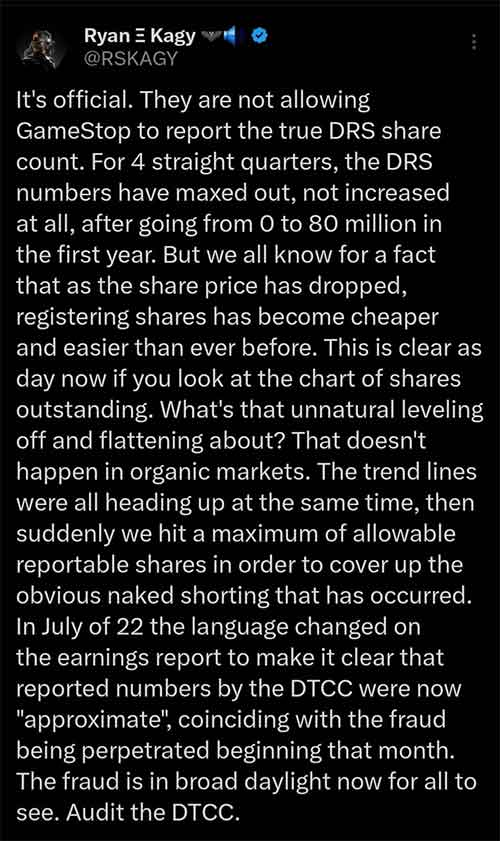

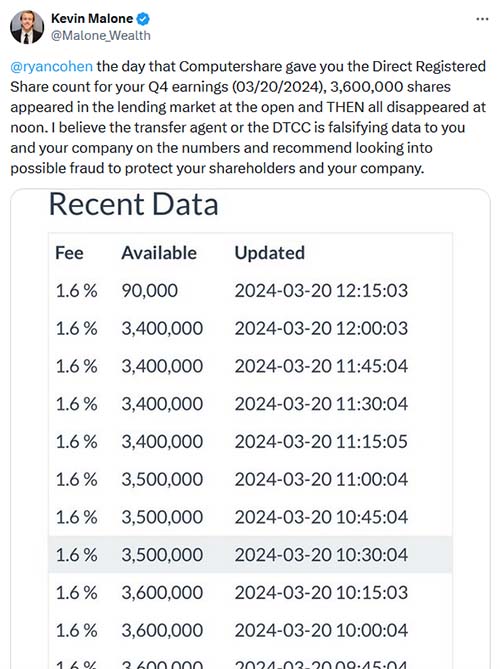

Being that a publicly traded company has never had its full shares direct registered, many investors are questioning why the DTCC is preventing GameStop from disclosing how many shares have been direct registered. What could possibly be the reason they do not want the public to know? Could the “theory”…

Read More

as one reader puts it ” He’s trying to normalize market manipulation in the minds of people. “Hey, this is just how the system functions and here’s other guys that do the same thing as us” I have a feeling those other firms are not happy about him lumping them…

Read More

A holding company is a company that owns other companies and oversees their operations but exists solely to operate those subsidiaries.

These new rules are supposed to allow more transparency in the market, particularly, the transparency would affect investment groups or hedge funds that are betting against a company. In other words, these financial groups make money only if the company fails or goes bankrupt.

These rules are supposed to bring about more fairness and transparency. What could be the reason these hedge funds are so afraid of this that they file a lawsuit against the same organization that is supposed to help protect and regulate them?

They are now pushing crypto coins and associating them with GameStop. Original Post: https://www.reddit.com/r/Superstonk/comments/1aeogop/this_is_the_most_insane_forget_gamestop_i_have/ Link to the actual media article below: https://www.benzinga.com/markets/cryptocurrency/24/01/36828433/forget-gamestop-stock-now-theres-a-gamestop-memecoin-and-its-worth-millions

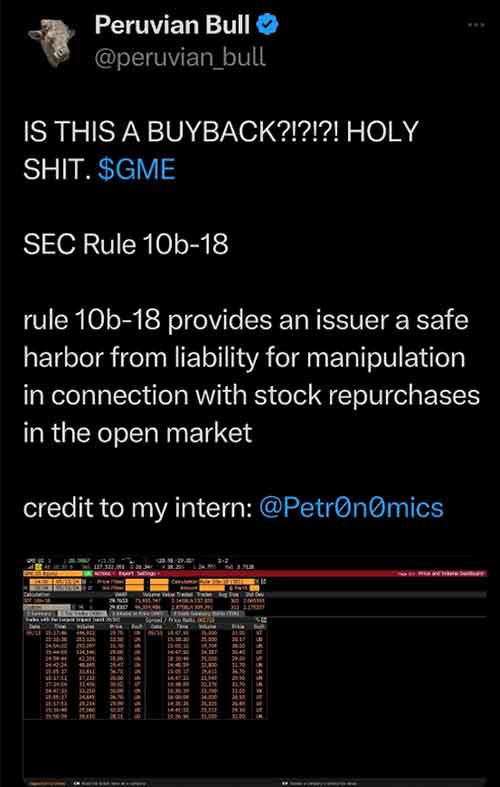

Peruvian Bull is also the author of The Dollar End Game

John Cena is popular movie actor and wrestler. It is not clear why he would post a GameStop store image on his Instagram.

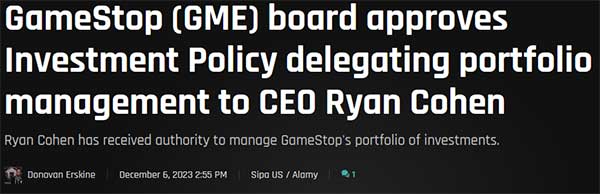

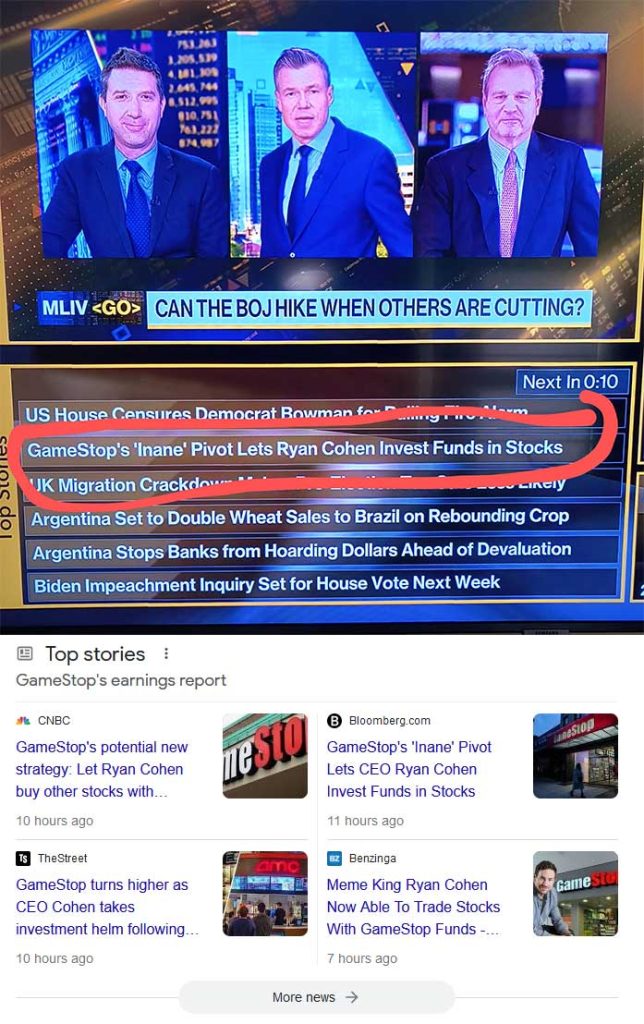

Gamestop started reporting the amount of Direct Registered shares but for the past few reports, the # of direct registered shares has been the same. Questions begin to arise as to why and how this figure has not changed for the past reports. There is some speculation that a certain…

Read More

Nobody knows exactly what happens when all the available shares are direct registered with GameStop’s transfer agent, ComputerShare. There is speculation that if in fact billions of fake shares were sold, these will need to be bought back at a much higher price than what they were originally sold for.

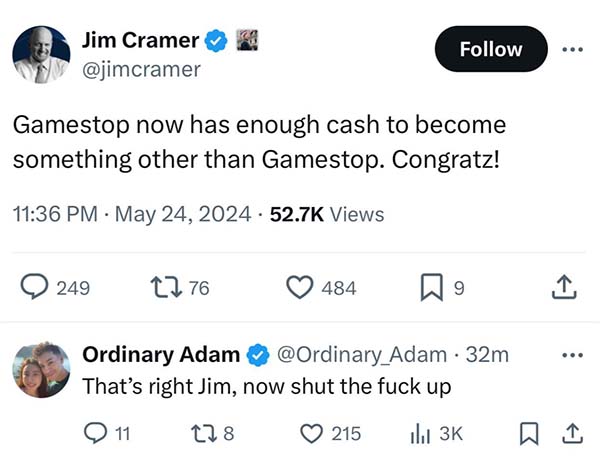

Jim Cramer is the tv host for Mad Money, a tv show on CNBC. The question is why wouldn’t they praise or congratulate GameStop? CEO Ryan Cohen is doing what no other CEO has done, aside from turning the company around and working on a $0 salary. Instead of being…

Read More

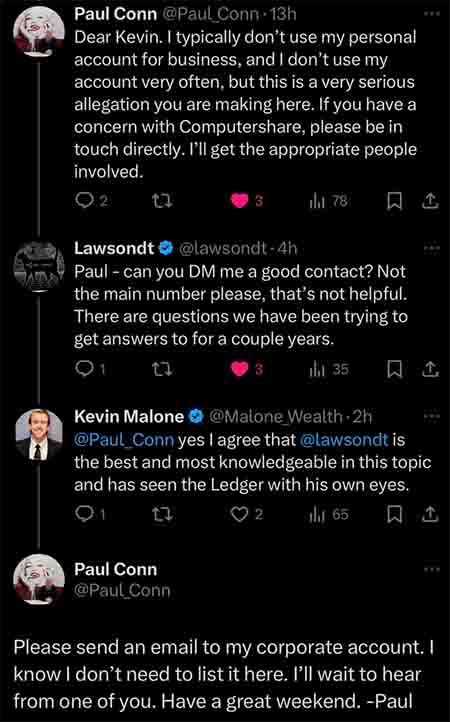

With so many doubts and questions as to why the reported number of Direct Registered Shares has not changed, hopefully this will help clear up any confusion and doubt as to what role transfer agent ComputerShare has when it comes to the # of direct registered shares that were published…

Read More

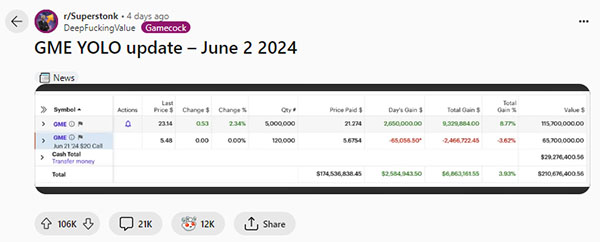

Keith Gill got famous for being one of the first deep value investors to openly talk about the value and fundamentals of GameStop. It is not exactly sure what or why he is posting now, but there is speculation he may have had a gag order that may have expired.

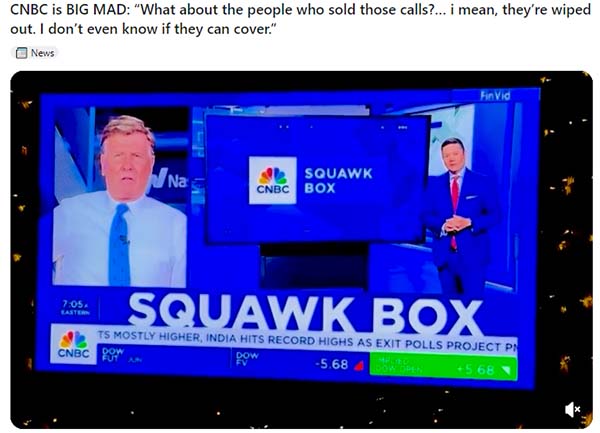

These were the same individuals blasting thousands of articles and hours on the TV bad mouthing GameStop CEO Ryan Cohen, making fun on individual investors, and insisting how bad of an investment GameStop is.

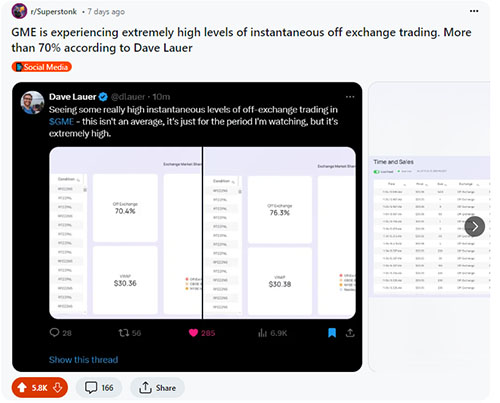

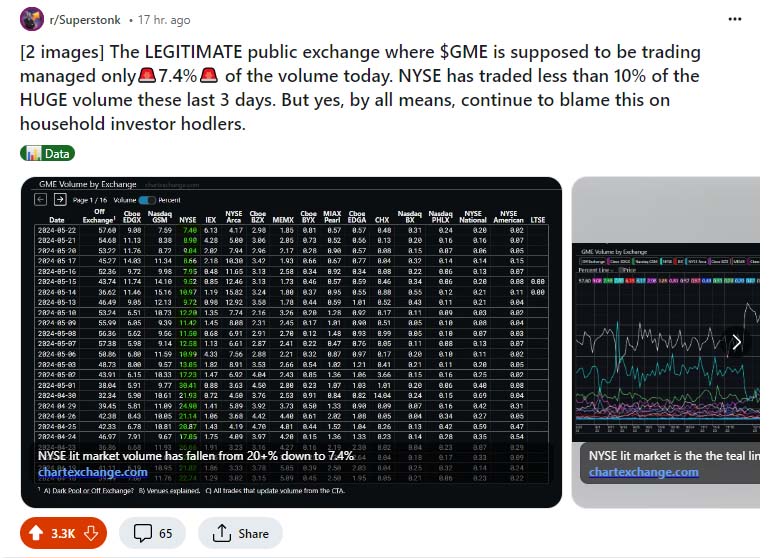

When stock trades are done “Off Exchange” it means the price is not impacted. There is no supply and demand. It would be comparable to a public auction closing its doors to the public, but still allowing certain buyers and sellers to do their own transactions without competition or bids…

Read More

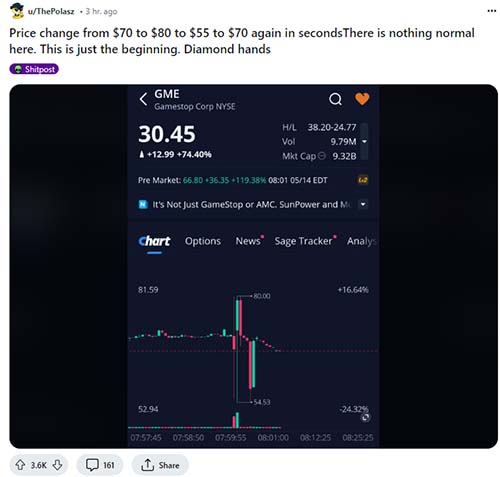

This is something that mainstream media, tv segments, online segments, interviews etc have all been denying. When there are more shares in existence, it could theoretically cause a short squeeze ( a sudden price surge that can go to prices as high as investors are willing to sell)

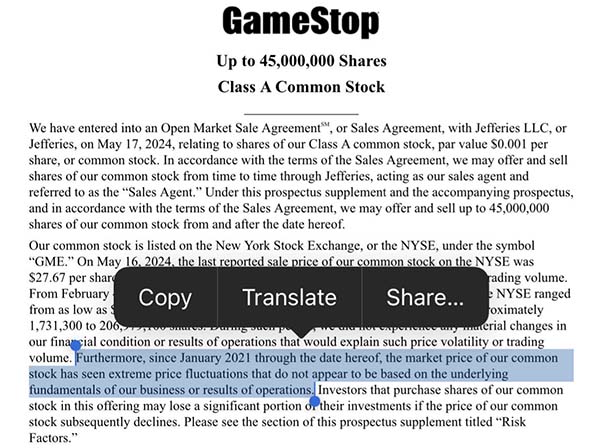

The company states “GameStop intends to use the net proceeds from the ATM Program for general corporate purposes, which may include acquisitions and investments.”

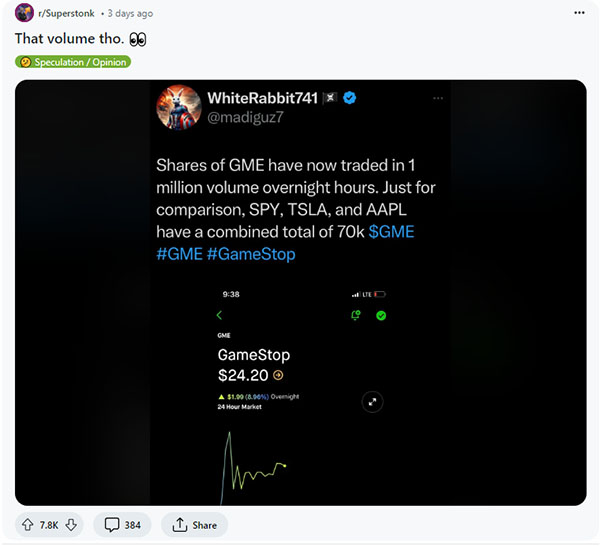

This one single post gets broadcasted around the world on news segments, articles, and social media.

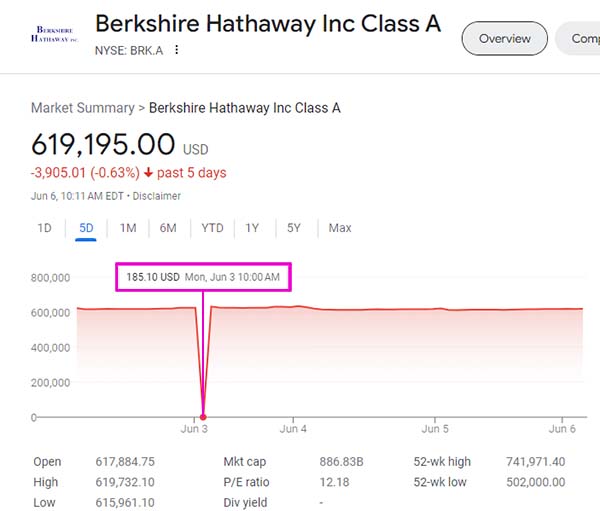

BRK-A is immediately suspended from trading and goes back to over $600,000 that same day. Whoever was able to purchase some of these shares at a discounted price will get the trades reversed. A few other stocks experienced similar price drops.

This is just speculation and for the record no official statement has been made by E-Trade or Morgan Stanley

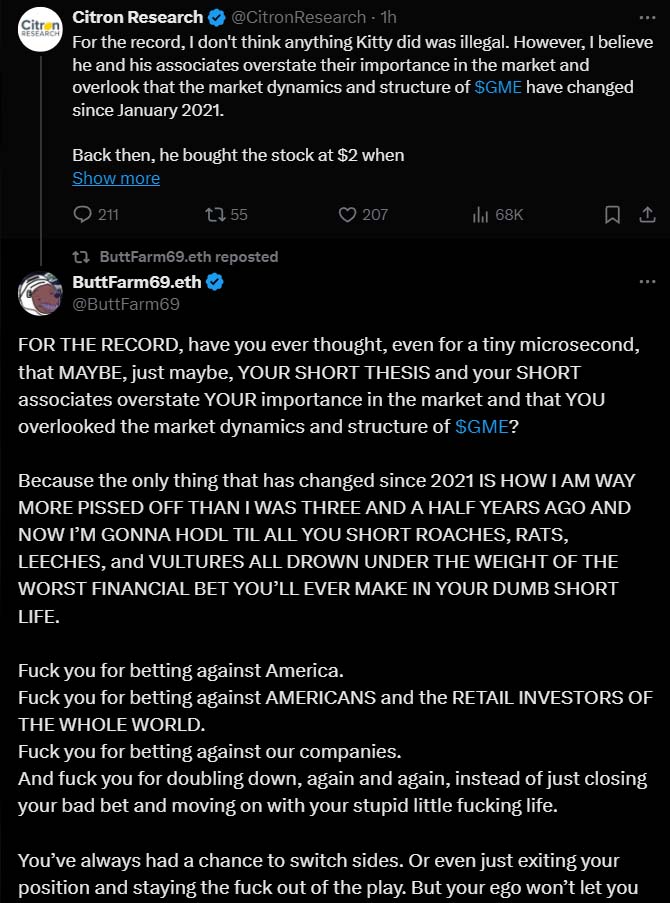

They start to blame Keith Gill for apparently single handedly causing the price of the stock to go up by simply posting his GameStop positions. It is quite ironic as every single day the media advertises their own stocks and pushes their own agenda about certain companies.

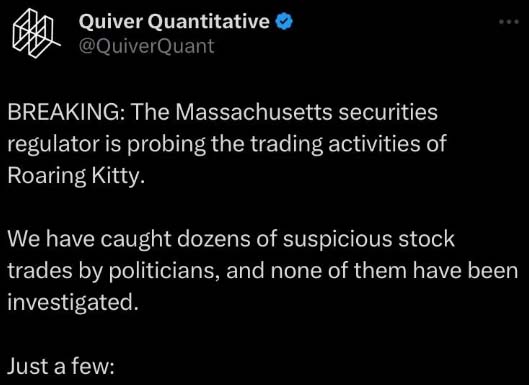

Citron Research was publicly humiliated when they first posted trying to humiliate GameStop investors back in Jan 2021.

The SEC is the Securities and Exchange Commission and are supposed to be in charge of market regulations, transparency, and fairness.